Can Jewellery Industry create more jobs in India?

The Mintly Team

October 24, 2022We all know that the surge of Covid-19 has slowed the world’s economy. The nations are building respective strategies to sail through this pandemic. The jewellery industry has also slowed down. But, if there has been an industry that has remained fluidic for many decades, it has been the gem and jewellery industry only. It is believed that Jewellery Industry will be the next big workforce generator in India.

The demand for jewellery has always existed and the artisans and jewellers have always pushed themselves harder to meet the demand in India. In this article, we will explore what lies ahead for this industry that has survived all odds.

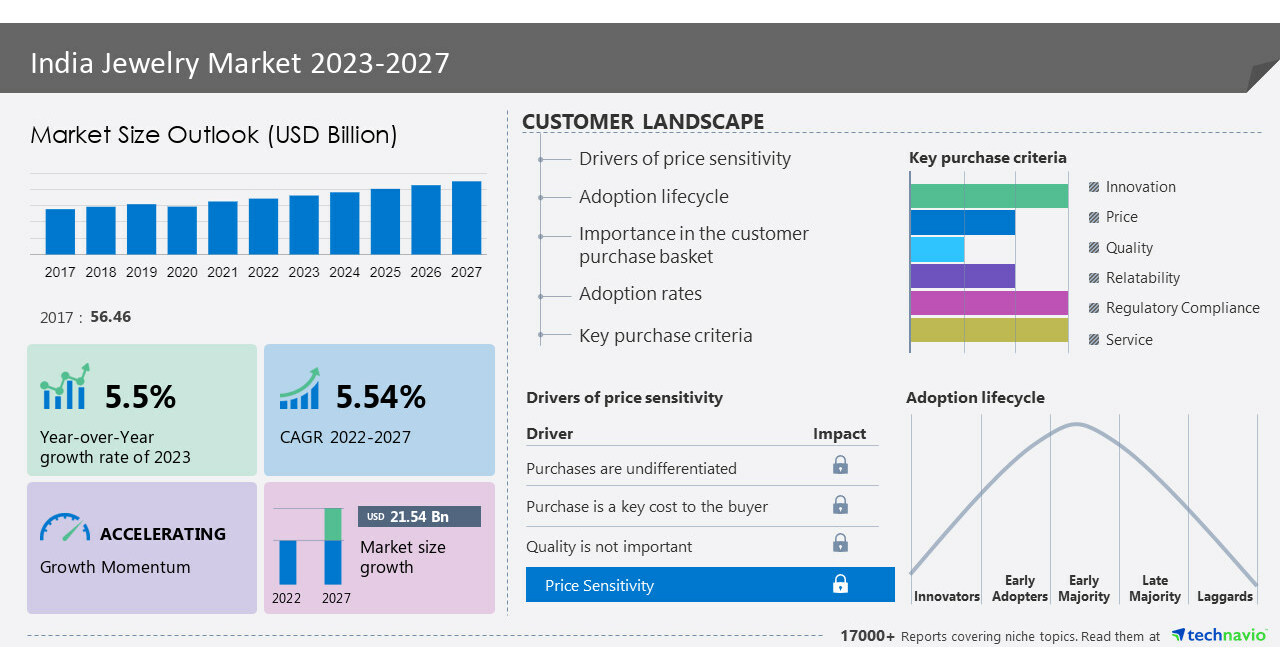

Jewellery Industry Market Size

The gems and jewellery industry plays a vital role in the Indian economy. The gems and jewellery industry being one of the biggest businesses in India contributes around 7% of the country’s GDP. It contributes 15.71% to India’s total merchandise exports. This is one of the fastest-growing sectors that are extremely export-oriented and also labor intensive. As a result, the industry brings in huge foreign exchange and gives employment to over 4.64 million workers, both in organized as well as unorganized sectors.

The gems and jewellery market in India is home to more than 300,000 players, with the majority being small players. Its market size is about US$ 60 billion as recorded in 2017 and is expected to reach $100-110 billion by 2021-2022. It is one of the largest exporters of gems and jewellery. The industry is contributing a major chunk to the total foreign reserves of India. UAE, the US, Russia, Singapore, Hong Kong, Latin America, and China are the biggest importers of Indian jewellery.

Here are a few reasons why Jewellery industry will be the upcoming big workforce generator or employment provider, especially in India.

Rising micro and small enterprises (MSEs) players

- The industry is already seeing an influx of established brands who are helping the market become more organized.

- Further, the growth in the gems and jewellery sector is likely to be dominated by the increasing penetration of new players.

- They are expected to not only unravel the potential to create new jobs. But will also contribute to the economy through voluminous exports.

- Jewelry stores / online jewelry brands are witnessing a surge in sales, which can be attributed to a demand which has been repressed for some time during the pandemic and has resulted in Revenge buying.

- Maximum development was driven by MSEs in gems & jewellery and textiles. It is recording the highest boost of 41% in November 2020, from the previous 13%.

- In November 2020, the adoption of digital distribution platforms among manufacturers of gems & jewellery, manufacturing mostly non-precious, stone-studded, imitation, and luxury fashion, more than quadrupled to 55% from 13% before the pandemic.

Contribution to GDP & Employment

As of February 2021, India’s gold and diamond trade contributed ~7.5% to India’s Gross Domestic Product (GDP) and 14% to India’s total merchandise exports. The gem and jewellery sector is likely to employ ~8.23 million persons by 2022, from ~5 million in 2020.

Importance of Gold in Indian Traditions

From considering gold as a mere investment to holding dignity in owning precious jewels, our country is a perfect example of that. There will be both emotional and rational intent to purchase Gold as it is considered to be a safe haven for investment. In India, it is beyond an adornment metal, rather a symbol of security. With changing times, we have witnessed different trends in the jewellery industry, be it the special occasions like weddings or auspicious days like ‘Akshay Tritiya’, etc.

- According to Gem and Jewellery Export Promotion Council, between April-October 2021, imports of the gold bars stood at US$ 1,372 million and gold jewellery stood at US$ 166.75 million.

- India’s gold demand stood at 797.30 tonnes in 2021.

- In Q4 2021, demand for gold rose by 93% over the same period a year ago to 265 tonnes.

- In India, gold demand in terms of volume increased by 37% YoY to 140 tonnes and in value terms, the demand increased by 57% YoY to Rs. 58,800 crore in Q1 2021, according to the World Gold Council.

- In Q2 2021, gold demand in terms of volume increased by 19% YoY to 76 tonnes and in value terms, the demand increased by 23% YoY to Rs. 32,180 crore

- Total jewellery demand in terms of volume increased by 25% YoY to 55 tonnes in Q2 2021

Gold Monetisation Scheme

- The Gold Monetisation Scheme was launched in November 2015. This scheme enabled individuals, trusts, and mutual funds to deposit gold with banks and earn interest on the same in return.

- As of January 2019, the Reserve Bank of India (RBI) increased the scope of the gold-monetization scheme. It is allowing charitable institutions and Government entities to deposit gold to boost deposits over the coming months.

- To reduce the country’s reliance on gold imports to meet the domestic demand Proposed jewellery park allocated. It is 25 acres of land in Navi Mumbai and 25,000 sq. ft of land in West Bengal

- Proposed policy to help increase the gold supply. Coming from local refineries to 80% in the next few years from current 40%

- India’s demand for gold is expected to reach 800-850 tonnes in 2022.

Marriage and Festive Season

We expect that the oncoming festivals and the consequent wedding season will rush the growth positively. The celebratory mindset of our returning customers looking to celebrate personal milestones will be adding to the demand.

- Most of the weddings planned during covid in 2019-20 have been deferred to coming years post-pandemic.

- We believe the share of wallet for wedding jewellery purchases will remain largely unaffected. Despite the new normal with wedding ceremonies being a close-knit affair in India.

- Even if families will not resort to lavish weddings, they will certainly look at gold as an embodiment of an auspicious beginning.

Increasing purchase of Minimalistic Jewellery

The trend of jewellery has shifted from heavy sets to lightweight adornments over the years. These minimalistic jewellery are easier to carry in every sphere of women’s life. It works best for working women, suits every decorum and occasion.

They are affordable by a majority segment. Also, the trend says jewellery is not only for women but for men as well, increasing the demand for it. According to the changing trend, lightweight classic designs are preferred for heavy jewellery. It has increased the demand for solitaire diamonds and svelte gold pieces of jewellery.

Online Selling by Gems & Jewellery Retailers

- Jewellery players in India are re-evaluating the brick-and-mortar business model. They are planning to implement an omni-channel approach with a focus on digital strategy to boost sales.

- According to the ‘Online Gold Market in India’ report by The World Gold Council, the online gold industry in India, with relatively nascent at 1-2% (in 2020), is witnessing a strong push from both digital players who view this as an opportunity to scale. The large jewelers view this market as a required addition to their brick-and-mortar model.

- A maximum number of people shop online, making jewellery shopping convenient. With door-to-door delivery of the jewellery sets with easy online payment methods, more people have started purchasing jewellery online.

- Heavy jewellery pieces are not easy to shop online because it requires the consumer to visit a shop to see the work for themselves. It is a notable investment compared to lightweight jewellery. But heavy artificial jewellery is available online for purchase as well as for rent, making it easier for customers to approach these.

- Companies have also started selling customized jewellery for customers who prefer to have their jewellery altered as per their own preferences.

Growing Demand

- India’s gems and jewellery exports are likely to reach US$ 40 billion in 2021-22, implying a growth of 6.5% over pre-covid levels.

- In October 2020, the first edition of IIJS Virtual* recorded >10,000 visitors and a business turnover of ~Rs. 1,000 crore.

- India ranks 1st among the top exporters in cut & polished diamonds. We are second in gold jewellery, silver jewellery and lab-grown diamonds.

- Established brands are guiding the organized market and are opening opportunities to grow. Increasing penetration of organized players provides variety in terms of products and designs.

- Online sales are expected to account for 1–2% of the fine jewellery segment by 2021–22.

- Also, the relaxation of restrictions on gold import is likely to provide a fillip to the industry. The improvement in availability along with the reintroduction of low-cost gold metal loans and likely stabilization of gold prices at lower levels is expected to drive volume growth for jewellers over the short to medium term.

Increasing Investments and Opportunities

- The cumulative foreign direct investment (FDI) inflows in diamond and gold ornaments stood at US$ 1,194.00 million between April 2000 and June 2021 according to the Department for Promotion of Industry and Internal Trade (DPIIT).

- In September 2021, Malbar Group invested Rs. 750 crore in a gold refinery and jewellery unit in Hyderabad.

- The Government has undertaken various measures recently to promote investment and upgrade technology and skills to promote ‘Brand India’ in the international market.

- Indian investment demand increased by 8% YoY to 48.9 tonnes in Q3 2021, as consumers boosted purchases of gold coins and bars.

- The Government has permitted 100% FDI in the sector under the automatic route, wherein the foreign investor or the Indian company does not require any prior approval from the RBI or the Government of India.

- The Government has reduced custom duty on cut and polished diamond and colored gemstones from 7.5% to 5% and NIL.

- India has signed an FTA with the UAE . This will further boost exports and is expected to reach the target of US$ 52 billion.

Trending Exports & Imports

- India’s gems and jewellery exports are likely to reach US$ 40 billion in 2021-22, growing at 6.5% over pre-covid levels.

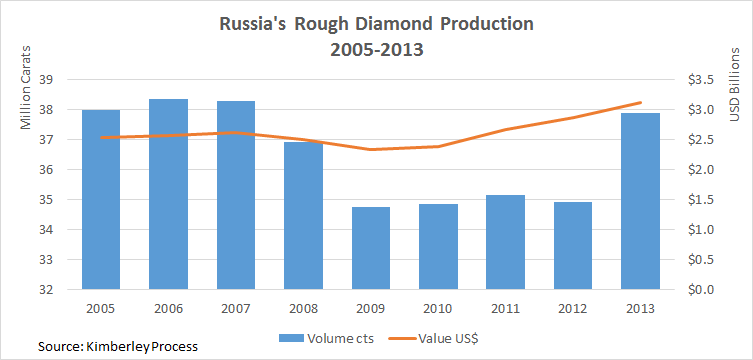

- Globally, India was the top exporter of diamonds with a share of 20.6% in 2020.

- Between April 2021-January 2022, India’s gems and jewellery imports stood at US$ 21.11 billion.

- From April 2021-January 2022, India’s overall exports of gems stood at US$ 32.37 billion, which is a 69.13% growth as compared to the same period last year.

- In January 2022, India’s overall gems and jewellery exports increased 23.66% YoY to US$ 3.28 billion.

- The Government of India is aiming at US$ 70 billion in jewellery export in the next five years (until 2025). This is up from US$ 35 billion in 2020.

Yet to Explore – Expansion into new jewellery category

- Retailers are focusing to expand into new jewellery categories to attract urban consumers.

- In February 2021, Reliance expanded its e-commerce arm, JioMart, to jewellery with silver coins of 5gm and10 gm, and gold coin jewelry of 1gm, 5gm, and 10gm.

- Reliance Jewels, the in-house jewellery brand of Reliance, operates approximately 93 flagship showrooms. It owns 110 shop-in-shops across 105 cities in the country. They will handle the orders for the new segment.

- Organized mining sectors must explore numerous mines of precious and semi-precious gemstones that have not been discovered yet.

- The country also needs institutions providing vocational training to aspiring artisans willing to make a living out of jewellery making and diamond and gemstone cutting.

Final thoughts

The jewellery industry has the potential to create a significant number of jobs in India. The jewellery industry has rich craftsmanship heritage and high demand both locally and globally. It can tap into India’s skilled and unskilled labor for growth. By providing jobs in mining, manufacturing, retail, and design, the industry can boost India’s economy and livelihoods.

To maximize this potential, challenges like skill development, technology, and ethical sourcing must be addressed. With proper support, the jewellery sector can become a catalyst for job creation and empowerment in India.

All Tags

Loading...

Loading...