Precious metals like gold, silver, platinum, and palladium have long been considered valuable assets, historically used as currency and a hedge against economic instability. With the advent of digital platforms, the accessibility and trading of these metals have evolved dramatically. This shift has not only democratized access but also introduced new dynamics into the market. In this blog, we will explore the multifaceted impact of digital platforms on the accessibility of precious metals.

Historical Context

Traditionally, trading in precious metals was limited to physical markets and over-the-counter (OTC) transactions. Access was primarily restricted to large financial institutions, wealthy individuals, and specialized dealers. This exclusivity stemmed from the complexities involved in storage, insurance, and transportation of these valuable commodities.

Emergence of Digital Platforms

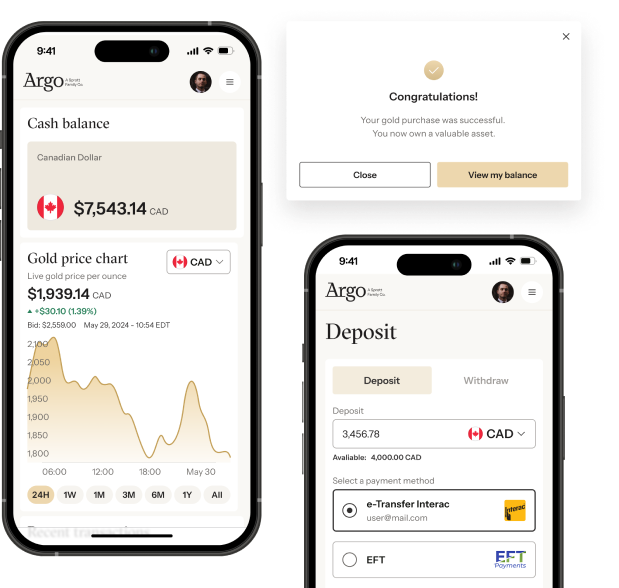

The rise of digital platforms has revolutionized this landscape. Online brokers, trading apps, and dedicated precious metals platforms have made it easier for individuals to buy, sell, and trade precious metals from the comfort of their homes. Companies like BullionVault, GoldMoney, and various cryptocurrency exchanges have lowered the barriers to entry.

Accessibility for Retail Investors

The most significant impact of digital platforms is the increased accessibility for retail investors. These platforms offer a user-friendly interface that allows anyone with an internet connection to participate in the market. This democratization has several key benefits:

- Lower Costs: Traditional methods of investing in precious metals often involved high premiums and commissions. Digital platforms typically offer lower fees, making it more cost-effective for small investors.

- Fractional Ownership: Many digital platforms allow for fractional ownership of precious metals. This means investors can buy smaller quantities, making it easier to start investing with limited capital.

- Ease of Transactions: The process of buying and selling precious metals online is straightforward. Users can quickly execute trades without the need for intermediaries or cumbersome paperwork.

Enhanced Transparency and Security

Digital platforms have also brought about greater transparency and security in the precious metals market. Blockchain technology, in particular, has played a crucial role in this transformation.

- Transparent Pricing: Online platforms provide real-time pricing data, ensuring that investors can make informed decisions based on current market conditions. This transparency helps prevent price manipulation and promotes fair trading practices.

- Secure Transactions: Blockchain-based platforms offer enhanced security features. Transactions are recorded on an immutable ledger, reducing the risk of fraud and ensuring the integrity of ownership records.

- Traceability: Blockchain technology allows for the traceability of precious metals from their source to the end consumer. This is particularly important in ensuring ethical sourcing and compliance with regulations.

Impact on Market Dynamics

The increased accessibility brought about by digital platforms has also influenced market dynamics in several ways.

- Increased Liquidity: The entry of retail investors has contributed to increased liquidity in the precious metals market. Higher liquidity often leads to more stable prices and reduced volatility.

- Diversification: Digital platforms have enabled investors to diversify their portfolios more easily. Precious metals can now be part of a broader investment strategy that includes stocks, bonds, and other assets.

- Global Reach: Digital platforms transcend geographical boundaries, allowing investors from around the world to participate in precious metals markets. This global reach has expanded the investor base and increased market activity.

Challenges and Risks

While digital platforms have undoubtedly made precious metals more accessible, they also come with their own set of challenges and risks.

- Regulatory Concerns: The regulatory environment for digital platforms is still evolving. Investors need to be aware of the legal implications and ensure they are using compliant platforms.

- Cybersecurity Risks: The digital nature of these platforms makes them susceptible to cybersecurity threats. Investors must take precautions to protect their accounts and personal information.

- Market Manipulation: While transparency has improved, there is still a risk of market manipulation in the digital space. Investors should remain vigilant and conduct thorough research before making trading decisions.

The Role of Cryptocurrencies

Cryptocurrencies have added another layer of complexity to the precious metals market. Some digital platforms allow users to trade precious metals using cryptocurrencies like Bitcoin and Ethereum.

- Increased Flexibility: Cryptocurrencies provide an alternative means of transaction, offering greater flexibility for investors who prefer to operate outside traditional banking systems.

- Volatility Concerns: However, the volatile nature of cryptocurrencies can introduce additional risks. Investors need to carefully consider the potential for price fluctuations when using cryptocurrencies to trade precious metals.

Future Prospects

The future of precious metals accessibility through digital platforms looks promising. Several trends are likely to shape this evolving landscape:

- Integration with Financial Services: We can expect further integration between traditional financial services and digital platforms. Banks and financial institutions may increasingly offer digital solutions for precious metals trading.

- Technological Advancements: Continued advancements in blockchain technology and artificial intelligence will enhance security, transparency, and user experience on these platforms.

- Regulatory Developments: As regulatory frameworks mature, we can anticipate greater clarity and protection for investors in the digital space.

- Sustainability Focus: There is a growing emphasis on sustainability in the precious metals industry. Digital platforms can play a crucial role in promoting ethical sourcing and environmentally responsible practices through transparent supply chains.

- AI: Fraud in Precious metals can be detected using AI technology while buying online.

Conclusion

Digital platforms have undeniably transformed the accessibility of precious metals, making it easier for individuals from all walks of life to invest in these valuable assets. While there are challenges and risks associated with this shift, the benefits far outweigh the drawbacks. Increased transparency, security, and global reach have democratized the market, contributing to greater liquidity and more stable prices.

As technology continues to advance and regulatory frameworks evolve, we can expect even more innovations in the world of precious metals trading. Whether you are a seasoned investor or just starting your journey, digital platforms offer a convenient and efficient way to participate in this dynamic market.

In summary, the impact of digital platforms on precious metals accessibility is profound and far-reaching, reshaping how we interact with these timeless assets in an increasingly digital age.