Investing in precious metals has long been considered a safe haven for investors looking to diversify their portfolios and protect against market volatility. Equity precious metals mutual funds for gold offer an attractive opportunity to gain exposure to the precious metals sector while benefiting from the expertise of professional fund managers. In this blog, we will explore the potential of equity precious metals mutual funds, their benefits, and considerations for investors.

Understanding Equity Precious Metals Mutual Funds

Equity precious metals mutual funds are investment vehicles that provide exposure to companies involved in the exploration, mining, and production of precious metals such as gold, silver, platinum, and palladium. These funds primarily invest in the equity securities of such companies, offering investors the opportunity to participate in the potential growth of the precious metals industry.

One of the key advantages of equity precious metals mutual funds is their ability to provide diversification within the precious metals sector. By investing in a variety of companies across different geographical regions, these funds can mitigate the risks associated with investing in individual mining companies. This diversification helps to reduce the impact of company-specific factors on the overall performance of the fund.

Investing in equity precious metals mutual funds also allows investors to benefit from the potential price appreciation of precious metals. As demand for these commodities increases, driven by factors such as economic growth, inflation concerns, and geopolitical uncertainties, the value of the companies involved in their production may rise. This can result in capital gains for investors.

Furthermore, equity precious metals mutual funds offer a convenient and cost-effective way for investors to gain exposure to the precious metals industry. Instead of directly investing in individual mining companies, which requires extensive research and monitoring, investors can simply buy shares of the mutual fund. This allows them to access a diversified portfolio of precious metals companies managed by professional fund managers.

However, it is important to note that equity precious metals mutual funds can be volatile and subject to fluctuations in the price of precious metals. Additionally, they may also be influenced by broader market trends and economic factors. Therefore, investors should carefully consider their risk tolerance and investment objectives before investing in these funds.

Benefits of Equity Precious Metals Mutual Funds

Diversification

Diversification is a strategy that involves spreading investments across different assets to mitigate risk. Mutual funds offer an avenue for diversification, including exposure to gold. By investing in mutual funds focused on gold, investors can benefit from the potential upside of the precious metal while reducing risk associated with holding only gold.

These funds typically hold a diversified portfolio of gold-related assets such as gold mining stocks, ETFs, or physical gold. Investing in mutual funds for gold allows investors to gain exposure to the gold market without the need for direct ownership or storage of physical gold, providing a convenient and diversified investment option.

Inflation Hedge

Mutual funds for gold are an effective tool for investors seeking an inflation hedge. Inflation refers to the general increase in prices of goods and services over time, leading to a decrease in the purchasing power of money. During periods of high inflation, traditional investments like stocks and bonds may lose value. However, gold has proven to be a reliable store of value during inflationary times.

Mutual funds that focus on gold enable investors to participate in the potential growth of the precious metal without directly owning physical gold. These funds invest in various gold-related assets such as mining companies, exchange-traded funds (ETFs), and futures contracts. By diversifying their holdings, mutual funds offer investors exposure to different aspects of the gold market while spreading the risk.

Gold has historically been considered a safe haven during inflationary periods. As the value of fiat currencies declines, the demand for gold typically rises. This increased demand can drive up the price of gold, providing a potential hedge against inflation. Mutual funds that specialize in gold allow investors to capitalize on this trend.

Investing in mutual funds for gold can offer several advantages. Firstly, these funds provide liquidity, allowing investors to buy or sell shares easily. Secondly, they offer professional management, as experienced fund managers make investment decisions based on market conditions and trends. Lastly, mutual funds provide diversification, reducing the risk associated with investing solely in physical gold.

Professional Management

Professional management plays a crucial role in the realm of mutual funds for gold. With the ever-changing landscape of financial markets, investors seek the expertise of professional managers to navigate the complexities of investing in gold through mutual funds. These managers employ their knowledge and skills to analyze market trends, assess risk, and make informed investment decisions.

Through professional management, mutual funds for gold offer investors a diversified portfolio of gold-related assets. This include gold mining stocks, bullion, and futures contracts. This diversification helps mitigate risk and maximize potential returns. Professional managers also actively monitor the performance of these funds, making adjustments as necessary to ensure optimal results.

Furthermore, professional management provides investors with access to in-depth research and analysis, enabling them to make well-informed investment choices. This expertise helps investors capitalize on opportunities in the gold market while managing potential risks effectively.

Liquidity

Liquidity refers to the ease and speed at which an asset can be bought or sold without causing a significant impact on its price. When it comes to mutual funds for gold, liquidity plays an important role.

Investing in mutual funds that focus on gold provides investors with exposure to the precious metal without the need for physical ownership. These funds typically invest in gold-related assets such as gold mining stocks, gold futures contracts, and gold bullion.

One advantage of investing in mutual funds for gold is the liquidity they offer. Unlike physical gold, which may require time and effort to sell, mutual funds can be bought or sold on the open market like stocks. This means investors can easily convert their investment into cash when needed without experiencing significant delays or price fluctuations.

The liquidity of mutual funds for gold allows investors to take advantage of market opportunities and manage their investment portfolios more efficiently. However, it’s important to consider other factors such as fees, performance, and risk before making any investment decisions

Convenience

Mutual funds offer convenience when it comes to investing in gold. With mutual funds, investors can easily gain exposure to the precious metal without the need for physical ownership. This eliminates the hassle of storing and securing gold. Moreover, mutual funds provide a diversified approach by pooling investors’ money to invest in a portfolio of gold-related assets.

This spreads the risk and increases convenience for investors who may not have the expertise or time to manage individual gold investments. Additionally, mutual funds offer liquidity, allowing investors to buy or sell shares at any time, providing flexibility and convenience in managing their gold investment.

Considerations for Investors

While equity precious metals mutual funds offer potential benefits, it’s important to consider the following factors before investing:

- Volatility: The precious metals sector can experience significant price volatility due to factors such as geopolitical events, economic conditions, and investor sentiment. Investors should be prepared for short-term fluctuations in the value of their investments.

- Risk of Company-Specific Factors: Equity precious metals mutual funds are exposed to individual company risks within the sector. Factors such as operational challenges, regulatory changes, or adverse geopolitical events can impact the performance of specific companies, which in turn affects the mutual fund’s returns.

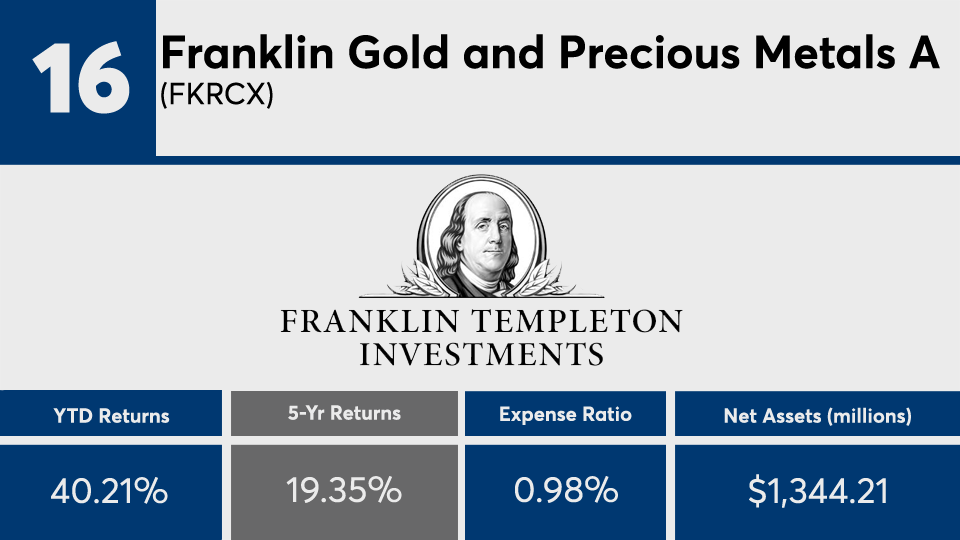

- Expense Ratios: Mutual funds charge fees known as expense ratios to cover management fees and operational expenses. It’s important to evaluate the expense ratio of a fund and assess its impact on your overall returns.

- Investment Horizon: Investing in equity precious metals mutual funds requires a long-term perspective. The performance of precious metals and related stocks can fluctuate over shorter periods, so investors should be prepared to hold their investments for an extended period to potentially realize gains.

- Market Research: Before investing in any mutual fund, it’s essential to research and evaluate the fund’s historical performance. Research about the fund manager’s track record, and the investment strategy.

Embrace the Potential of Equity Precious Metals Mutual Funds

Equity precious metals mutual funds offer investors the opportunity to participate in the potential upside of the precious metals sector while benefiting from professional management and diversification. By considering the potential benefits and conducting thorough research, investors can make informed decisions about whether equity precious metals mutual funds align with their investment goals and risk tolerance.

As with any investment, it’s crucial to consult with a financial advisor and carefully assess your individual circumstances before making investment decisions. By doing so, you can unlock the potential benefits of equity precious metals mutual funds and navigate the exciting world of precious metals investing.

Final Thoughts

Equity precious metals mutual funds hold significant potential for investors seeking exposure to the precious metals sector. These funds invest primarily in companies involved in mining and exploring for gold, silver, and other precious metals. The potential of these funds lies in their ability to provide diversification and act as a hedge against inflation and economic uncertainties.

Additionally, the performance of equity precious metals mutual funds is closely tied to the price movements of precious metals. It is offering investors opportunities for capital appreciation. However, it’s important for investors to carefully analyze the fund’s track record, management team, and expense ratios before making investment decisions in this specialized sector.